Don't Let the Stock Market Spook You

As if Halloween season isn't scary enough, ongoing market volatility has been unsettling investors. But much like the temporary frights you experience when walking through a haunted house, navigating the market's ups and downs are all part of the journey towards a better Return on Life.

Answer these three questions and the things that go BOO! in your portfolio right now might feel a little less frightening.

1. What am I really afraid of?

Anytime problems feel overwhelming, it's a good idea to try to shrink the issue down to size. So, instead of just feeling "afraid" about the market's bumpy 2022, try to pinpoint what, specifically, has you spooked.

For example, are you worried that you won't be able to retire in the next six months because there's a dent in your nest egg?

Are you a new retiree and you're worried that market volatility, combined with inflation, is going to reduce your purchasing power and standard of living?

Is your company struggling in this uncertain economic environment and you're worried about a potential layoff?

There's nothing that any of us can do about market volatility. But if you're anticipating a change in your income stream, you can adjust your budget. If your job doesn't feel stable, you can brush up your resume and start reaching out to your professional network.

And if the path towards retirement is unclear, you can meet with your financial advisor and review how your plan is designed to support you no matter what's happening in the markets.

2. What adjustments can I make and what opportunities are available?

Again, one of the most powerful ways to take control of your money is to review your household budget. Look at your last six months of bank and credit card statements and you'll probably find a subscription you're not really using or a bad habit that you can correct, like eating too many expensive carry-out meals.

You should also consider talking to your financial advisor about potential adjustments to your saving, investing, or withdrawal plan. Perhaps now is the time to tap into a retirement savings bucket so that you can keep living your best life while you wait for the markets to stabilize. Or, your advisor might be able to help you identify some "buy low" opportunities that will grow in value over time.

3. What does the big picture look like?

Fundamentally, most investors understand that volatility is a temporary pain we endure on the way to long-term growth. But the combination of high inflation, war in Europe, COVID variants, political and economic turmoil in Great Britain, our own contentious elections, and the possibility of a recession have many nervous investors concerned that this time might be different.

It's important to remember that while Gross Domestic Product numbers suggest we might be nearing a recession, other important economic data, such as low unemployment and a high number of job openings, show that the economy may be stronger than cable news and social media would have you believe.

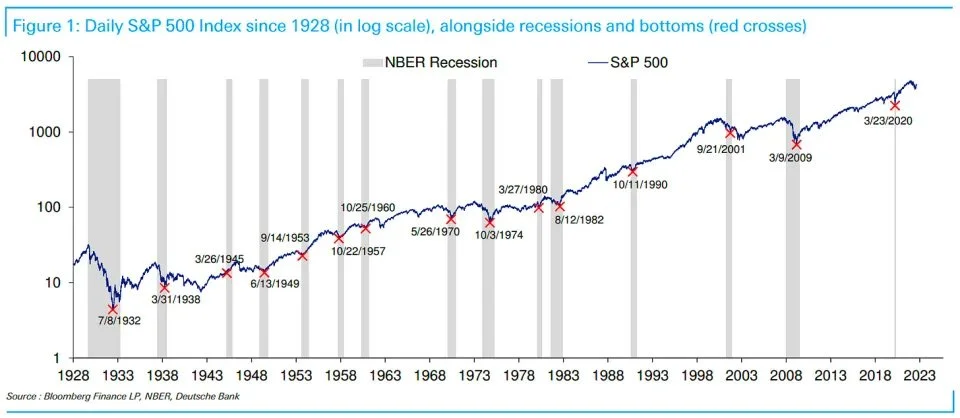

To widen our lens even further, take a look at this chart of daily S&P 500 returns since 1928.

Source: Yahoo News

There are many scary and tumultuous points on this timeline, from the Great Depression and World War II to 9/11 and the Great Recession. And while the S&P 500 experienced significant losses when the economy did slip into a recession, it also has, historically, recovered those losses and continued to grow.

However, it's very possible that stock market scares are going to continue after Halloween, and potentially into next year. If you’re still having nightmares about your nest egg, let’s talk soon about our market outlook and your Life-Centered Financial Plan.